Seller’s Inspection Checklist

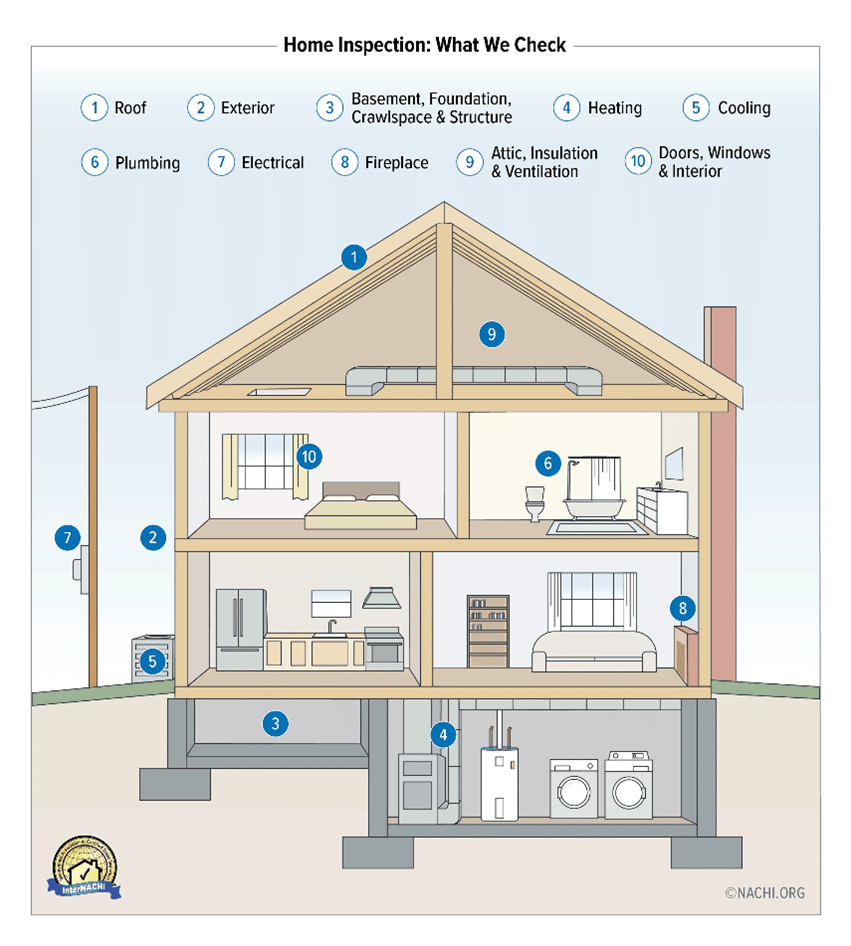

Odds are favorable that the buyer of your home will hire a home inspector to conduct a pre-purchase, due diligence home inspection as a condition of purchase. The home inspector will also prepare important insurance reports required by insurance carriers. While your buyer may be willing to accept some repairs or obsolescence in the home, most insurance carriers will not. Presenting favorable insurance reports may mean the difference in your ability to sell the home for the price you need.

Sometimes, we find sellers are simply not prepared to present the home for inspection. Chances are your listing agent advised you to make the home presentable but there is a difference between “presentable” and “ready for inspection”. Remember, the inspector will be taking photographs which will be reviewed not only by the buyer but also by insurance underwriters. You want your home to look clean and well-maintained.

Seller’s Inspection Checklist

Follow this guide to make your buyer’s home inspection a smooth process.

- Make sure all areas of the home are accessible. Remove clutter/stored goods. Make sure the inspector can access electrical panels, plumbing in sink cabinets, air handlers, water heaters, and windows. Provide clear access to the attic opening or other attic scuttles inside the home (remove clutter in closets blocking access). Inspectors must disclose areas that they could not inspect due to restricted/limited access, and this can often result in a return inspection which creates delay.

- Kitchen. Make sure sinks, ovens/ranges, and dishwasher is ready to inspect. Do not leave plates/silverware in the dishwasher – the inspector needs to test it. Remove clutter from countertops.

- Laundry. Remove clothes from the washer/dryer. Clean behind the washer/dryer.

- Pets. If possible, pets should be removed from the home or crated. Please consider removing pet droppings from the yard. Clean stains from floors/carpets.

- Water staining in ceilings. If you had prior leakage, sellers should seal/paint water stains as they must be noted on any insurance reports. No insurance carrier today will insure a home if there are visible water stains in ceilings/walls, even if the leakage is no longer present.

- Clean all windows, especially in the garage. It is common to find termite wings in cobwebs in garages or porches. Termite wings are reportable as evidence on a WDO report.

- Make sure all lights are functional. Replace burnt bulbs so the inspector does not need to report the light fixture as not functioning.

- Clean the showers. Remove mildew and staining from tile walls. Some inspectors may report this as possible mold.

- Have the HVAC system serviced and make the technician post a service tag on the air handler. Insurance carriers want to know the date of the last service – it’s important. Clean the air handler coil and blower to remove dirt/grime which may be reported as “suspected mold” (it’s not, but it may be reported as such). You can clean this yourself with a can of coil cleaner from a hardware store.

- Perform spring cleaning on the exterior. If needed, pressure wash and clean the gutters.

- Caulk/grout. Caulk gaps/cracks at doors, windows, and wall penetrations. Grout any gaps in shower walls/floors.

- Water-damaged/rotted wood. Repair/replace any water-damaged wood. It may be reported as damage on a WDO inspection and it is not acceptable in a VA loan (VA loans include detached buildings).

- Leave remotes for fireplaces/fans/pool equipment where the inspector can find them.

- Programmable thermostats. Disable programming on thermostats so the inspector can test the system.

- Security systems. Disable security systems before the inspection. It is common for the inspector to open the home using Supra EKey and they may not know the security system is activated.

- Locked doors. Leave all interior doors unlocked to allow access.

- Window blinds/coverings. If possible, open all blinds/drapes to allow access to the window. The inspector is not responsible if window coverings/rods fall when opened. The inspector needs to test the window for functionality. We do not typically test window coverings.

- Trim tree limbs/bushes away from the structure. Tree limbs overhanging roofs are a concern to insurance carriers.

- Sprinkler system. Make sure the system is functioning with no visible leakage.

- Roof. Remove leaves and tree branches from the roof. You want the roof to look its best.

- Plumbing. Insurance carriers are very strict on plumbing components. Inspectors must present photos of piping, valves, and fixtures. Make sure sink plumbing is visible (clean out cabinets). Clean the water supply and toilet valves and remove any corrosion. If any fixture is leaking, have it repaired before the inspection.

- Disclosure. If you know a component is not working, disclose it upfront. Post a note on the unit. Buyers appreciate honesty. If you have a repair/replacement scheduled, let the buyer know.

Insurance Reports

The insurance reports may be more critical than the home inspection. If your buyer can’t obtain affordable homeowners’ insurance, the deal may be dead even if the buyer is willing to accept some obsolescence. Here are a few examples of things insurance carriers are concerned about:

- Aged electrical panels. Few carriers will accept panels manufactured by Federal Pacific, Bulldog Pushmatic, Challenger, Zinsco, GTE Sylvania, or any fuse panel. If you have one of these, you should have it replaced before listing the home for sale.

- Polybutylene piping. Regardless of the year installed, few carriers will accept polybutylene plumbing.

- Asphalt shingle roofs over 15 years old. Regardless of condition, few carriers will underwrite any shingle roof over 15 years old.

- Solid aluminum branch circuit wiring. Regardless of whether the breakers are properly rated, few carriers will underwrite this wiring. Most carriers will accept upgraded connectors such as AlumiConn. If you have solid aluminum wiring, you should have the connections upgraded before listing the home for sale.

- Cast iron drain lines. CI piping was mostly discontinued in 1980 by builders so it is typically associated with homes built before 1980. While some carriers will insure it, it will generally require a premium.

- Water heaters. Must have a pressure relief valve and proper overflow piping.

- HVAC units. Age is not as important as having a recent service tag. Have the system serviced within the last year.

- Water stains. No carrier will issue a policy if there are visible water stains in ceilings/walls including the garage. It doesn’t matter if these are old stains.

- Exterior. The inspector must submit elevation photos of the home. Carriers are reluctant to insure any home which has overgrown vegetation, mildew stains on walls, clogged gutters, firewood or other materials stored against the walls or in general, anything that makes it appear the home is not maintained. Clean up landscaping, remove debris/clutter and make your home look presentable.

Property360

For all of your property inspection needs, contact Property360 at (904) 606-1570 to request an inspection today! If you are in need of pest control services, contact our sister company, 360PestControl, to request service. Our teams are here to help throughout Jacksonville, Orlando, St. Augustine, Lake City, and the surrounding areas.